Optimizing Medical Billing Efficiency with a Centralized App for Insurance Claims

A Custom Management App to Improve Efficiency and Increase Employee Accountability

A medical billing company specializing in services for anesthesiologists, sought to enhance the efficiency and accountability of the department that handles denied or delayed insurance claims for anesthesiologists, and the faulty existing processes which were impacting revenue and performance. A new system was needed to streamline workflows, integrate with the legacy billing platform, and provide real-time oversight for managers across global offices. The custom solution Mono delivered improved claim resolution speed, increased accountability, and enhanced managerial capabilities.

Industry

Medical Billing

Company overview

The client is a mid-sized company serving US hospitals with offices worldwide, providing software solutions for medical billing

The Challenge

The company faced inefficiencies in their medical billing operations, particularly in handling claims that were delayed or denied by insurance companies. The so-called Follow-up department, tasked with managing these claims, struggled to keep up with the workload, which impacted the company’s revenue and client satisfaction. The legacy system relied on manual data entry and lacked specialized tools for operators to manage follow-up tasks efficiently. This resulted in several challenges:

Inefficient processes

Operators had to sift through irrelevant data, causing delays in resolving claims.

Lack of accountability

With no performance tracking, operators had minimal motivation to work efficiently.

Managerial challenges

Managers struggled to monitor daily activities and assist operators effectively.

Integration constraints

A new system was needed that would integrate with the legacy billing system without disrupting ongoing operations.

High employee turnover

International offices faced challenges with training and retaining follow-up operators.

These issues led to delays in receiving payments from insurance companies, negatively impacting cash flow and operational efficiency. The lack of transparency also hindered scalability and the overall effectiveness of the Follow-up department.

The Solution

The development process focused on understanding the specific needs of the Follow-up department. Through a detailed assessment of existing workflows and feedback from operators and managers, Mono designed a custom application that improved claim management and integrated seamlessly with the client’s billing system.

Key Features

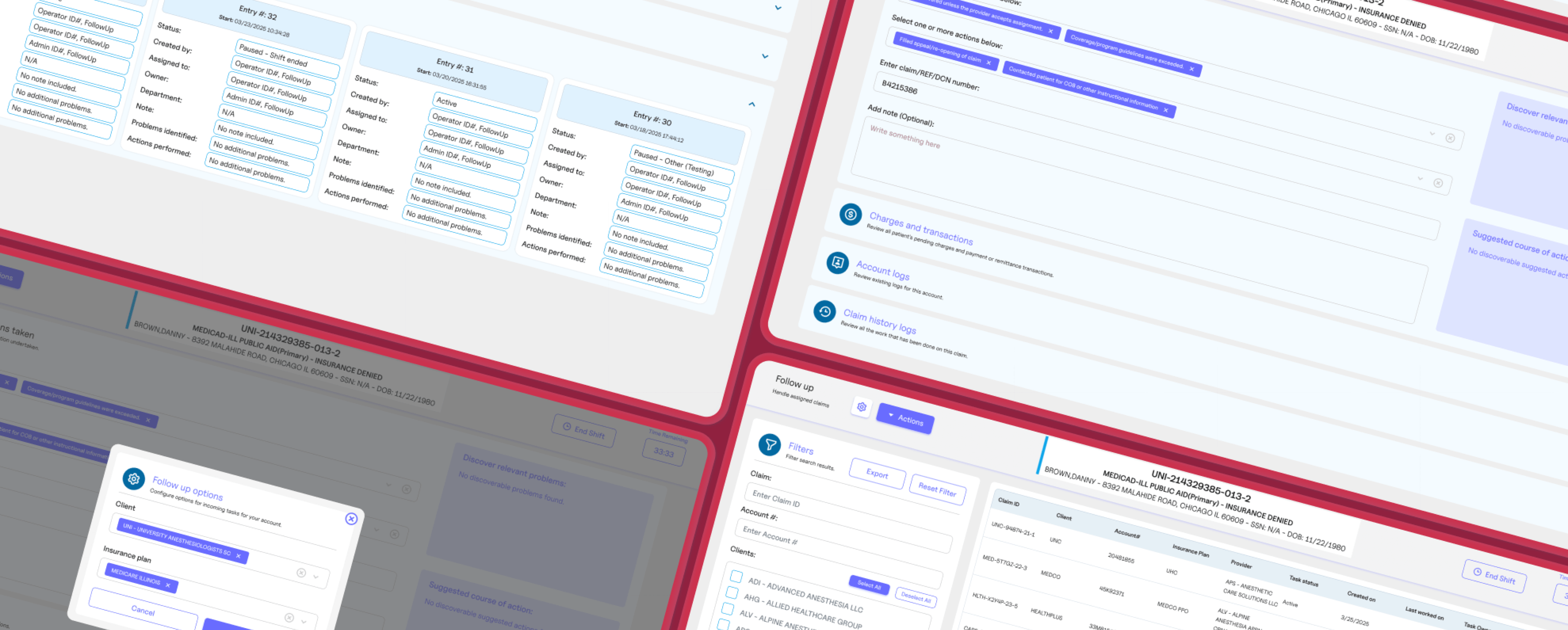

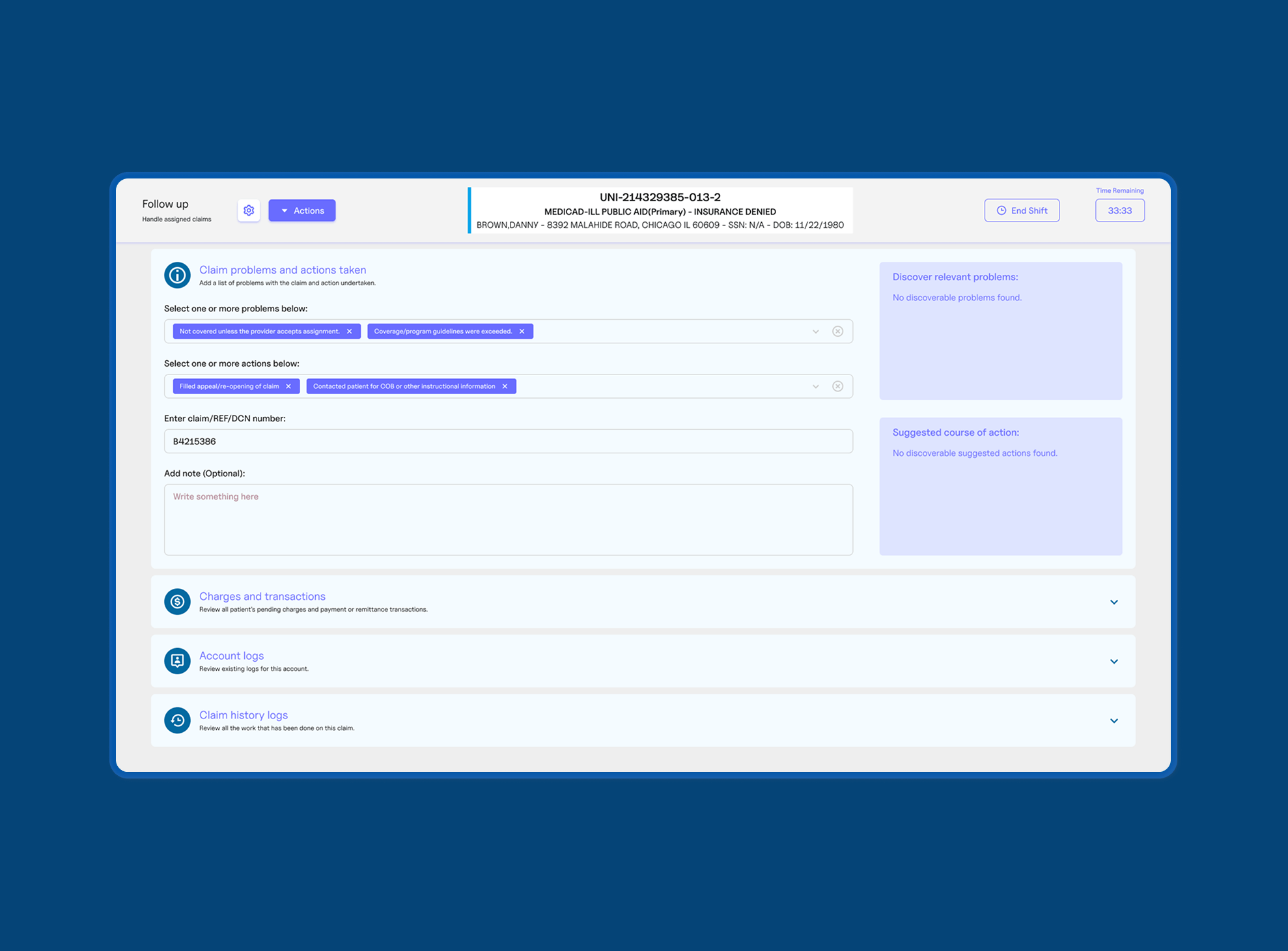

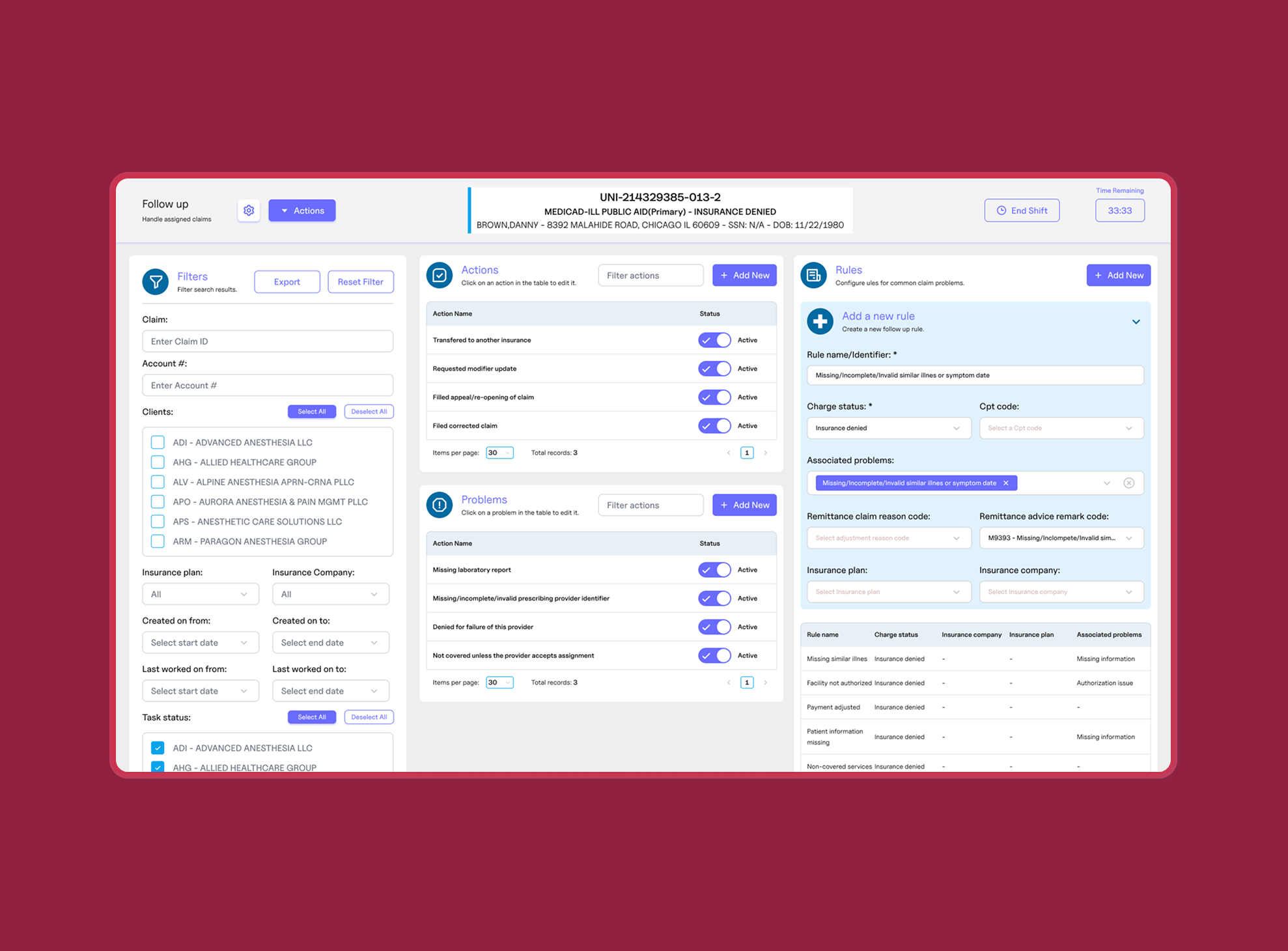

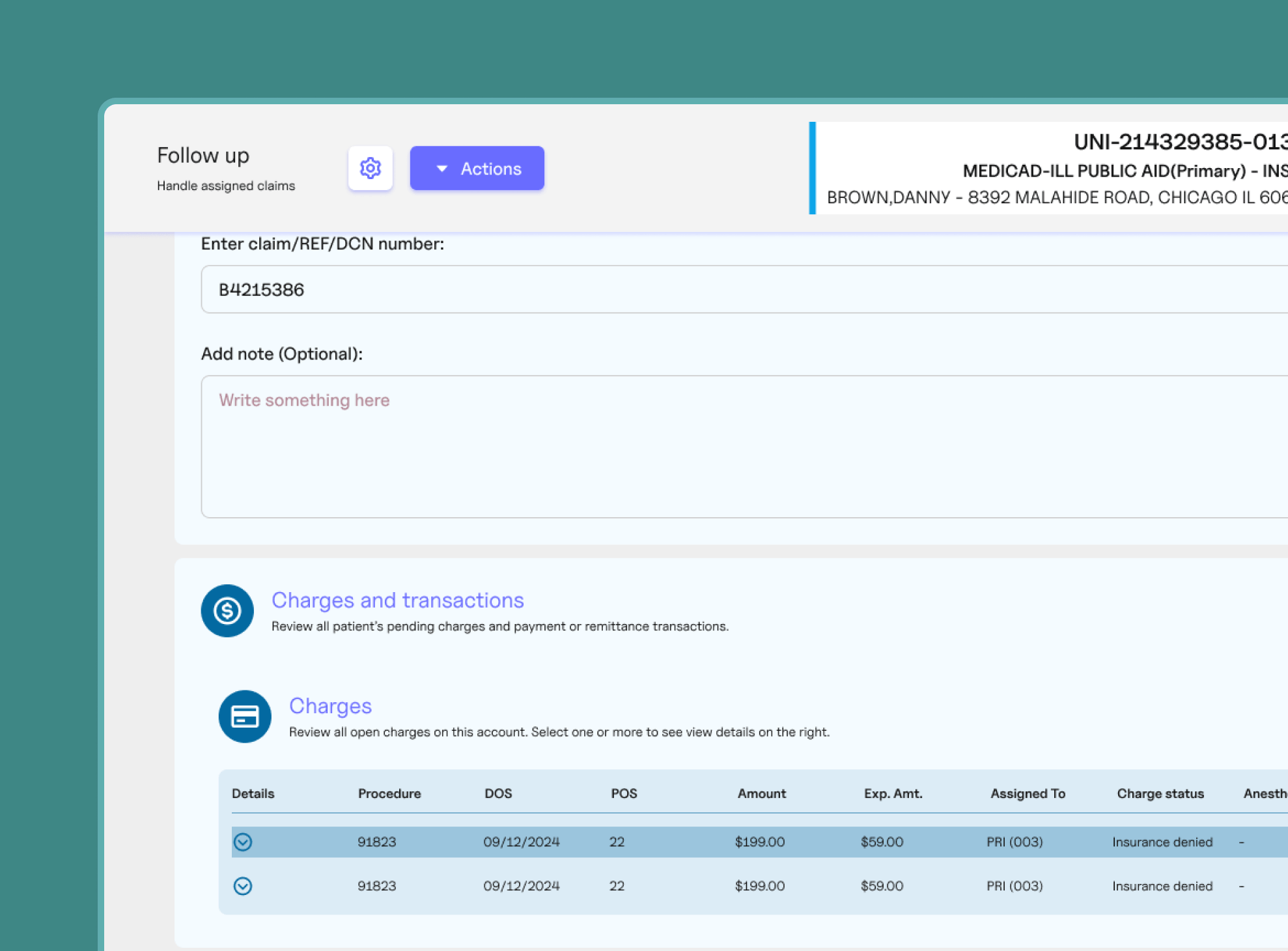

Streamlined operator interface

A user-friendly interface focused on presenting critical claim information, reducing distractions, and enabling faster resolution.

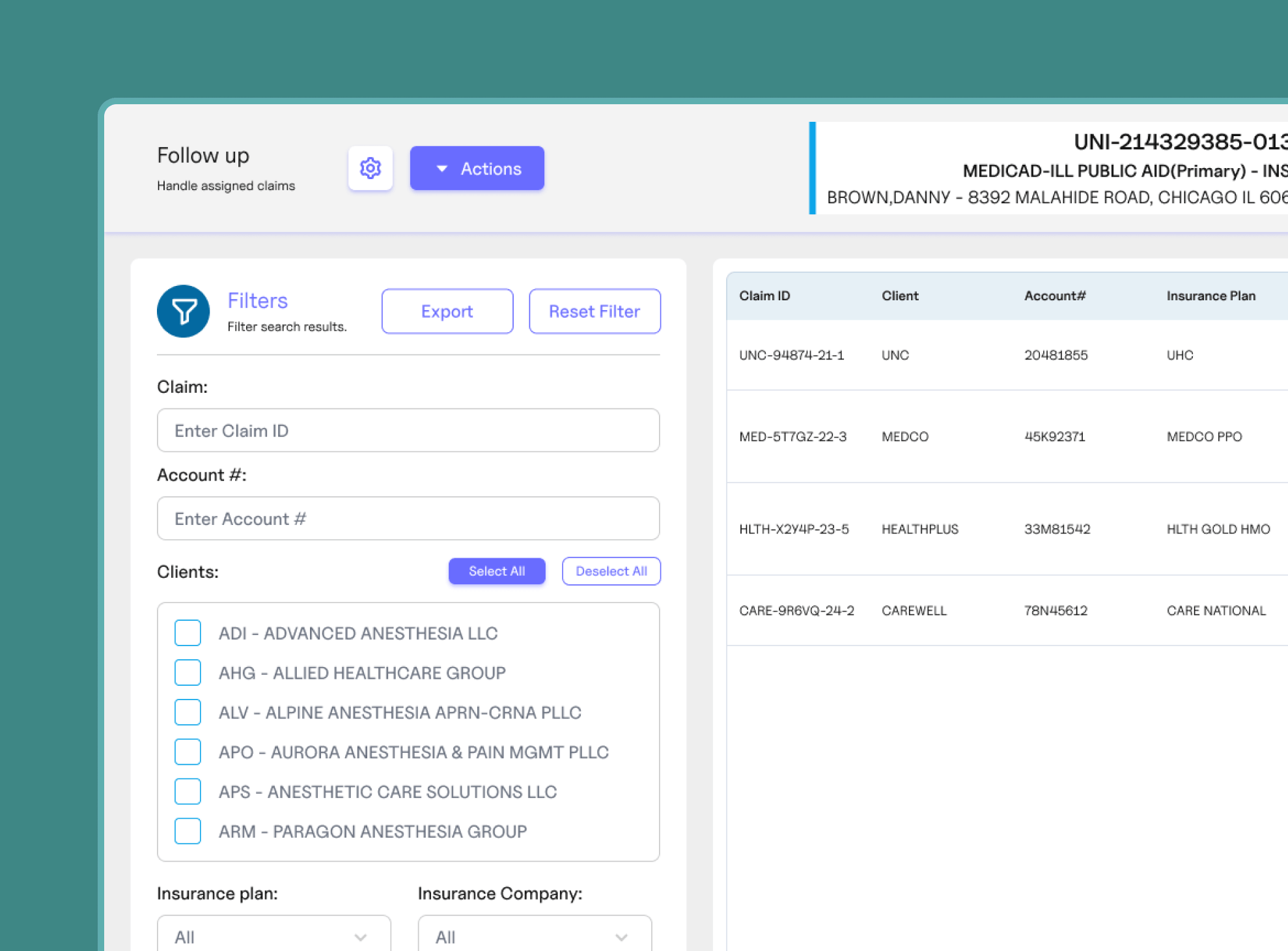

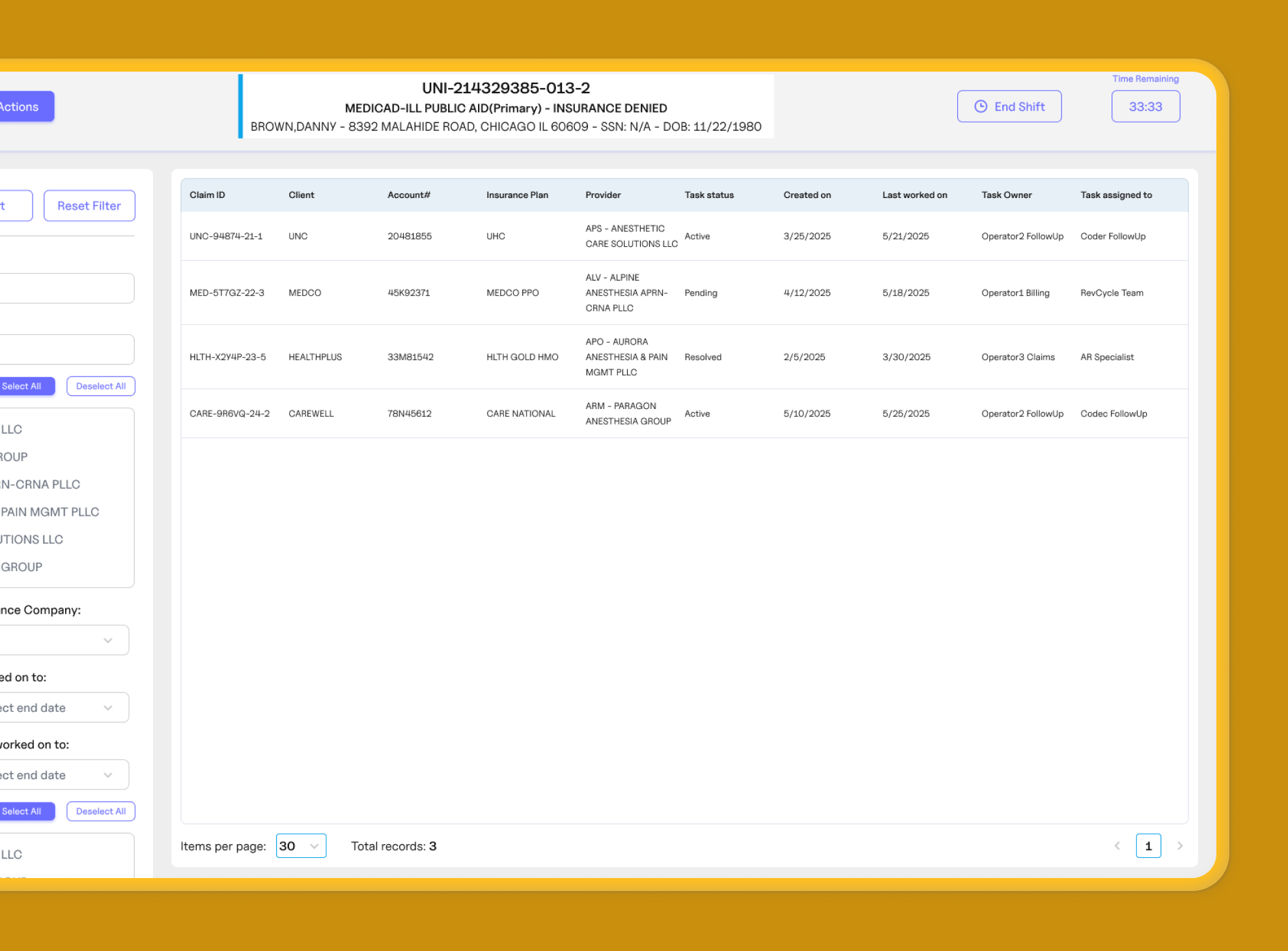

Automated claim assignment

Algorithms prioritized claims based on factors like expiration, denial status, and operator expertise.

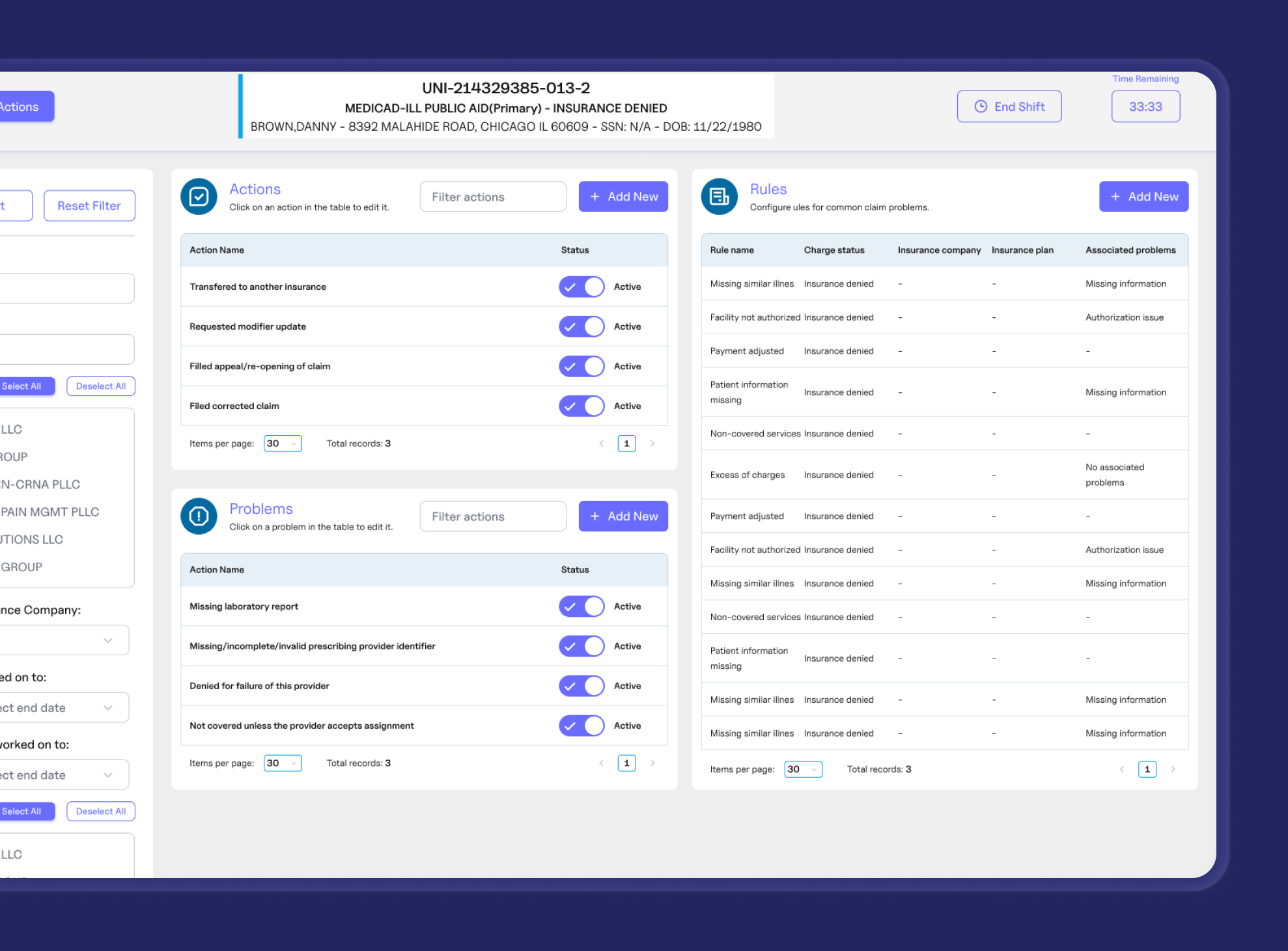

Customizable timers

Timers adjustable by user seniority and claim complexity improved task completion times and accountability.

Integrated communication tools

A built-in chat system allowed for seamless collaboration between operators and managers or other departments.

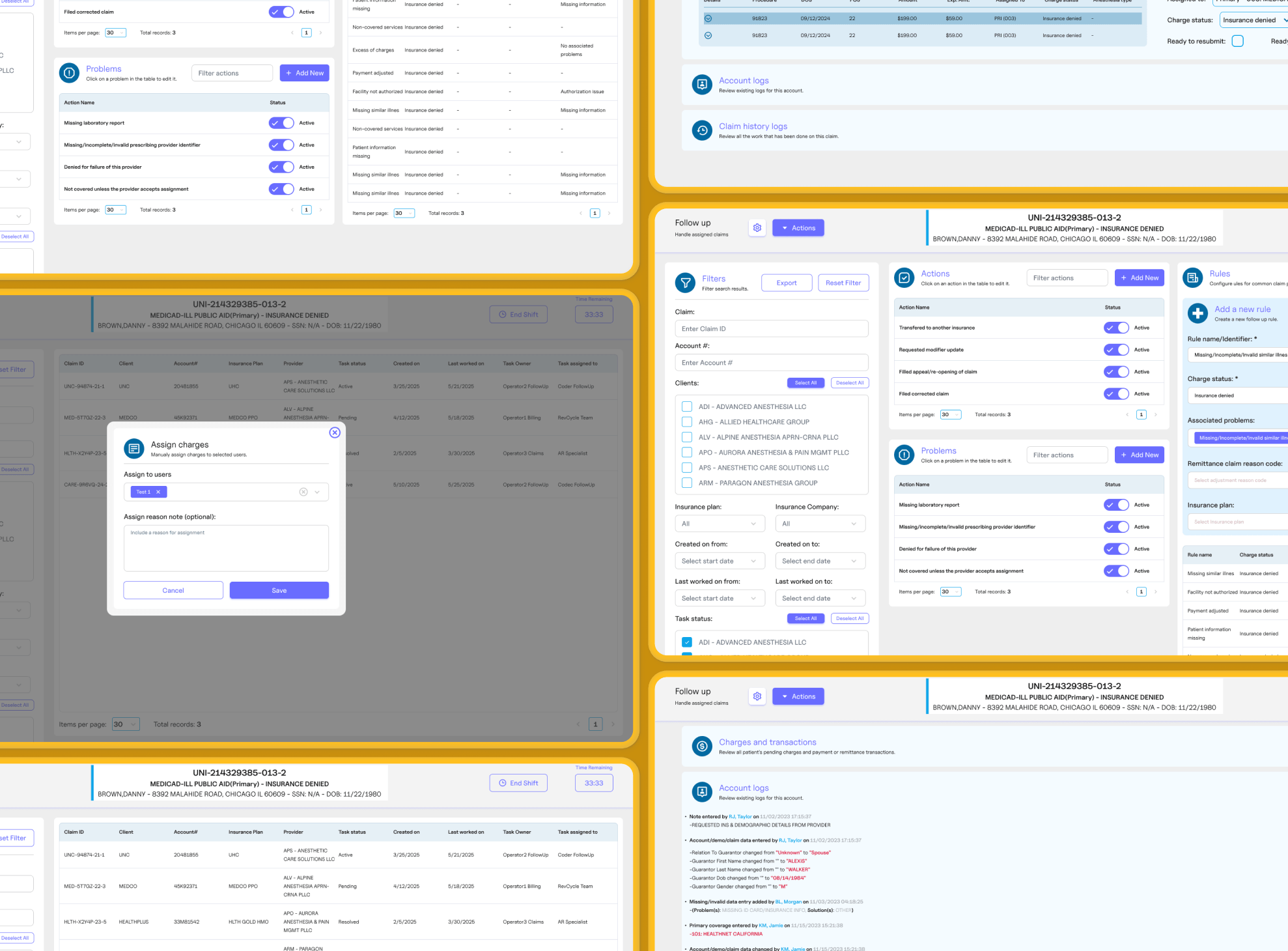

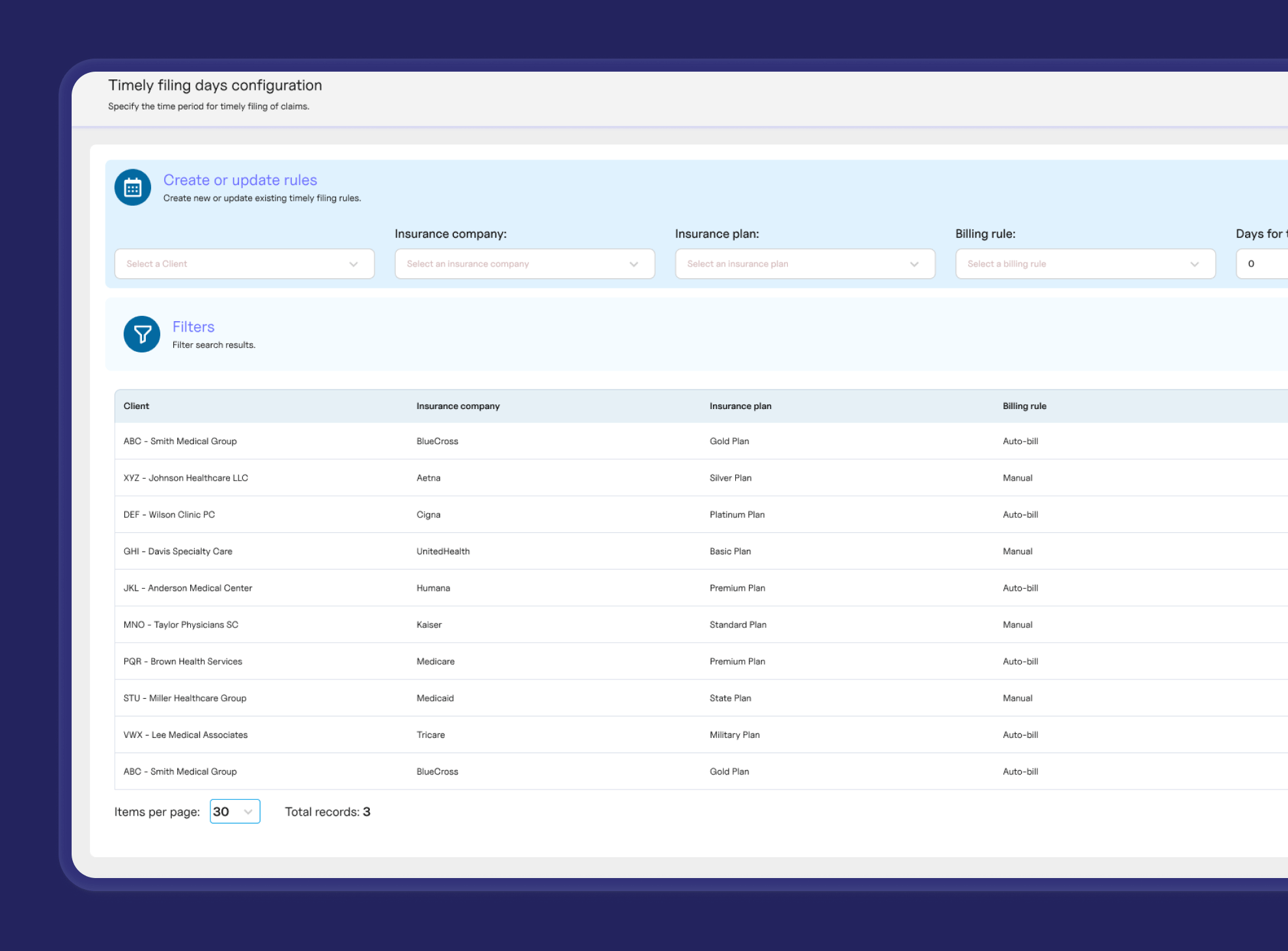

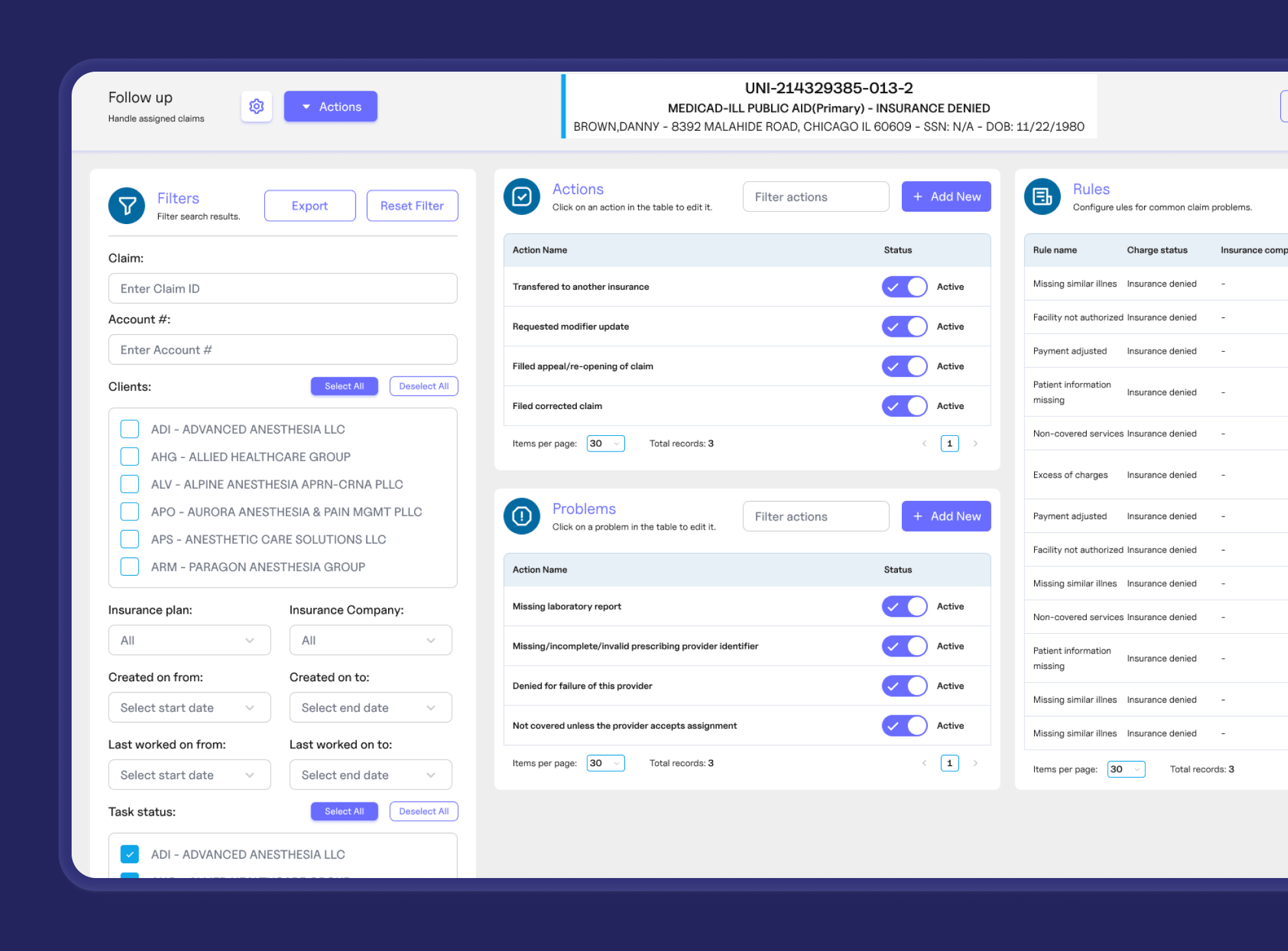

Configuration settings

Managers could customize how claims were presented and set time allowances based on insurance type.

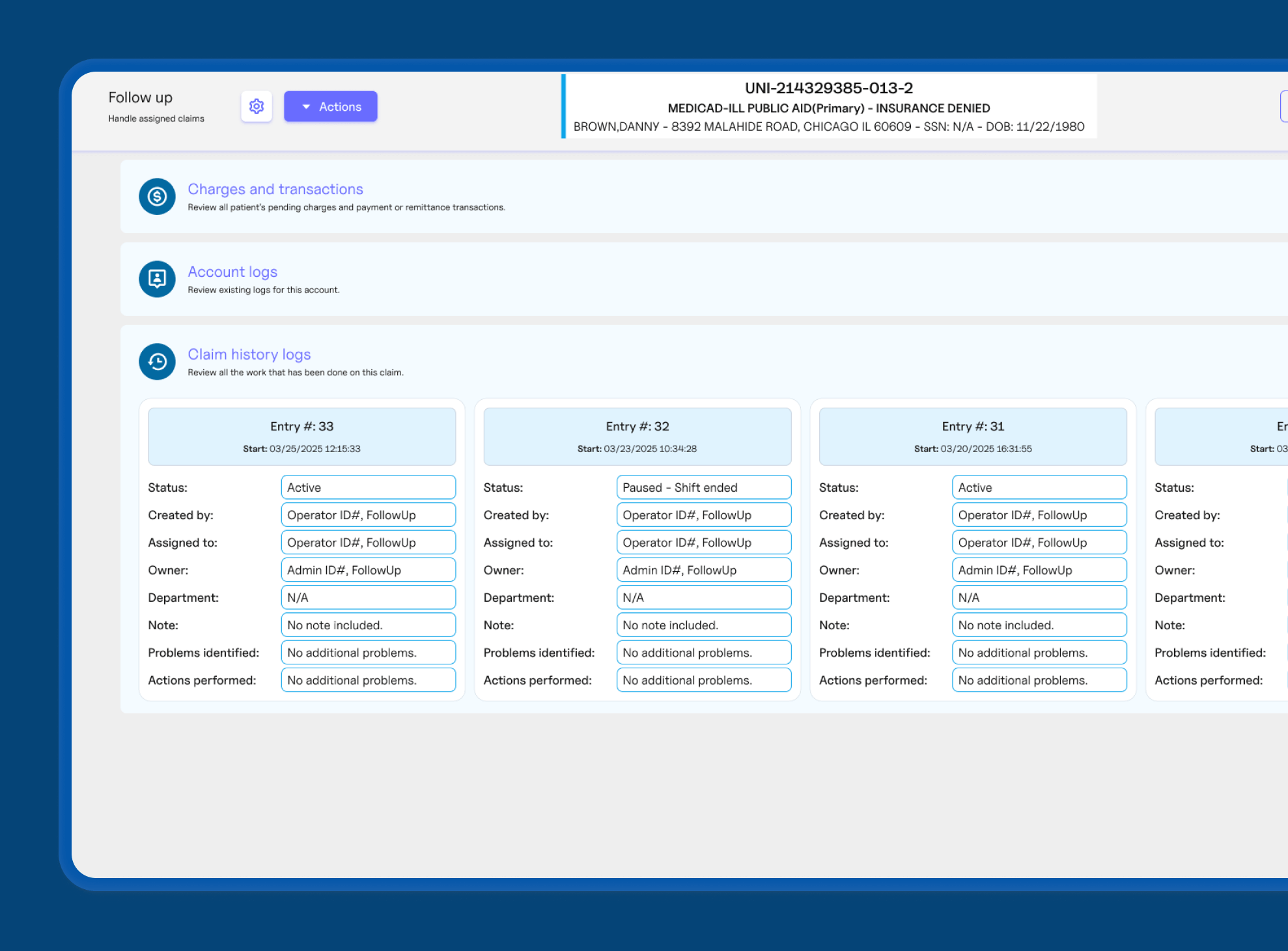

Real-time monitoring tools

Managers received real-time alerts, notifications, and performance tracking to assist operators and optimize workflows.

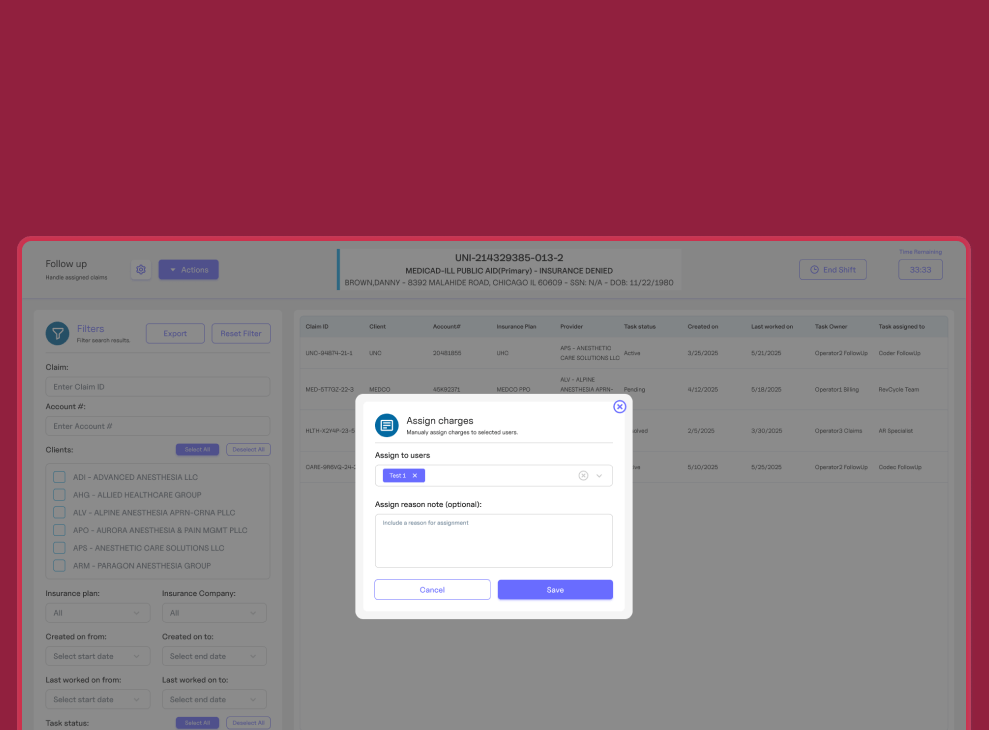

Work distribution

Managers could assign or reassign claims and create work batches for better oversight.

Results and Outcomes

The implementation of the new system significantly improved the efficiency and accountability of the Follow-up department, streamlining workflows and enabling faster claim resolution. With real-time monitoring tools, managers gained better oversight, allowing for prompt intervention and workload adjustments to optimize performance. These improvements led to quicker insurance payments and a more effective billing process.

Operators benefited from a user-friendly interface and automated claim prioritization, reducing manual effort and increasing productivity. Customizable timers enhanced task management, while integrated communication tools fostered seamless collaboration. As a result, the company experienced faster claim processing, improved cash flow, and increased operational transparency.

Faster claim resolution

Automated workflows and streamlined interfaces reduced delays in processing denied or delayed claims.

Enhanced accountability

Customizable timers and real-time tracking ensured operators met performance expectations.

Improved managerial oversight

Managers could monitor workloads, adjust assignments, and support operators more effectively.

Seamless integration

The system integrated with the existing billing platform without disrupting daily operations.

Increased efficiency

Optimized work distribution and automated claim assignments helped operators handle higher volumes with greater accuracy.

Conclusion and Future Plans

The successful implementation of the custom follow-up management system led to significant operational improvements for the client, particularly in terms of increased efficiency and accountability.

Looking ahead, future plans include expanding the application’s reporting capabilities to provide deeper insights into claim processing, along with helping operators resolve claims with the help of AI.

Discover how our tailored solutions can help streamline your processes and enhance your productivity.

If your business is facing challenges with complex workflows or needs an integrated solution to improve operational efficiency, reach out to us today.